Charlotte January 2022 – Key Take Aways

- Brian Schoeck – Johnston Allison Hord – Shared that Alyson Craig was recently named Charlotte’s Interim Planning Director following Taiwo Jaiyeoba’s newly-elected position as Greensboro’s City Manager. Views this as positive considering her existing relationship with the development community. He announces second draft of the UDO map posted this week. Approval from City Council is scheduled for February 2022. Brian finishes with a statement from a JLL fourth-quarter report, which declares Charlotte led the nation in construction of office space for 2021 with 4.9 million square feet. This emphasizes the strength of current Charlotte office market.

- Joe Kinsey – CoStar Group – Mentioned CoStar’s Chuck McShane’s office market report, which claims Charlotte is second only to Austin. This growth raises concern regarding the large amount of vacant space in Charlotte as well as backfilling issues that may arise. i.e., Duke Energy’s decision to reduce its real estate footprint with move into Duke Energy Plaza. He’s finding adaptive reuse in FreeMoreWest and South End popular, however he believes suburban, and airport might find this more challenging. Tenant activity is up on LoopNet. He’s hearing push out to Charlotte because of water/sewage issues. Columbia’s being mentioned as well. Industrial and multi-family clients, especially non-institutional investors, are attempting to find space/properties/deals in rural areas, outside of Charlotte.

- Gates Grainger – Investors Title Company – He states industrial and multi-family segments are doing incredibly well. He’s also seeing diversity with unprecedented retail and hotel deals, with a recently closed deal in Nashville as well as two shopping centers in Union County. He speculates Charlotte will enter more diverse places, whether in-state or out.

- Joe Marek – Johnston Allison Hord – He admits busy start with several retail, land and office projects. All are wanting new construction, according to a JLL report. Landlords are figuring out how to provide those amenities. Green space, new parking, touchlists, etc. are gaining popularity.

- Tanna Thomas – Terracon – She shares that Airbnb listed Charlotte as the #1 in adding listings this year than before. There is a huge need for accommodation and assumes there will be more need for hospitality.

- Chris Woods – Whiting-Turner – He sees positive growth in all sectors. Multi-family developers are asking about multi-family products, whether it be high-rise, mid-rise, or both combined. Hospitality side closed two hospitality deals in the last month. He notes money is flowing easier than it was a year ago. Industrial side showing a lot of movement and opportunities to renovate existing manufacturing facilities. 75% of work in Charleston office is on industrial side. Food and beverage and cold storage side are busy as well. Nationally, he doesn’t see any slow down with escalation continuing. However, he is experiencing a labor shortage driven by: (1) a 20% decrease in qualified labor with only 80% of people returning from Covid, and (2), seeing vaccine mandates on different sites for different customers which is limiting capable workforce, and (3) supply chain/material issues.

- Matt Kmec – Whiting-Turner – He expresses supply chain issues, such as limited steel, with data/call centers. Big companies like Apple and Facebooks’ data centers will also place a significant strain on qualified electricians, and therefore, on the labor resource itself. Seeing a significant amount of development from I-485 down to Greenville/Spartanburg area.

- Russell Hughes – Hughes Realty Advisors – He shares that bids/contracts for hospitality were kicked down the road but are coming back and moving online. He sees growth in suburban office yet challenges in finding industrial land for clients. He notices search for returns in unheard of ways, i.e. retail, hospitality, Ablemarle, Locust.

- Heather Mucci – Novus Architects Inc. – She shares that there is an uptick in municipal work. On the hospitality side, growth in renovations and new builds in Charlotte and other parts of the country. She is having daily industrial discussions with clients, not necessarily resort but to support business and travel. Pre-made design supporting restaurants, food trucks and entertainment in the cold storage and industrial sector. Healthcare is extremely busy. Seeing more conversions versus builds, i.e. Walgreens versus hospitals.

- Katie Reilly – Ragona Architecture & Design, PLLC – Small team of regional architects, licensed in 14 states and covering all market sectors. She and her team are doing work with wellness centers, multi-family, hotel and corporate architecture. She is seeing a spike in daycare franchise growths. She notices financing changes, with first-time entrepreneurs and brokers attempting to find inventory with limited budgets. There are many upfront surprises long before the architecture aspect because of change of use to buildings, so she works backwards with her clients’ budgets to find them the best scenario.

- Pat Pierce – Selwyn Property Group – Small firm initially with a handle on multiple disciplines. He expresses excitement regarding Alyson Craig as new Interim Planning Director. Industrial and multi-family currently very active. He has two 2022 projects, one being on the high-profile side of East Blvd. and the other in Raleigh. He notes investors are entering “forward sales”. The discount from what they’ll pay for the building and whether it’s leased or unleased is minute. This gives sense of investor’s big appetite for industrial product in Charlotte, even considering the construction and leasing risks. Challenge for all these projects are constructions costs and finding the right opportunity/piece of land.

- Jon Phillips – Selwyn Property Group – Jon shared that tenants are reacting to rent growths in unheard of ways. People are signing leases at 20 percent above pre-covid rent and accepting annual escalations of 3.5-4 percent. He believes delta will be blunted from sheer demand. We may see blip but not much. Large buildings going up in market but there is still a need for smaller, closer facilities. Hard to find good sites, mainly due to physical/infrastructure issues as well as attitude amongst some planning groups that industrial side cannot coexist with other uses. He admits that will have to change.

- Leah Maybry – SignatureFD – SignatureFD is a wealth management firm, based out of Atlanta, that manages over $6 billion for its clientele. Its regional, sister company is Frazier & Deeter. Leah has a heavy emphasis on tax planning for her real estate and professional clients alike.

- Marty Cotton – Stewart-Cooper-Newell – He notes no slowdown, especially in public safety. During the recession, this sector was typically last to get funded. Post-recession, everybody came back to even and now is seeing planning on further developing communities, i.e. Waxhaw.

- Trevor Hess – HessGroup – He states the market demands faster, larger portfolio management for real estate/construction/architecture sectors. Unfortunately, the software platform cannot support architecture side because it is too slow. HessGroup helps this issue by identifying what makes project successful all the way down to ceiling materials/furniture choices.

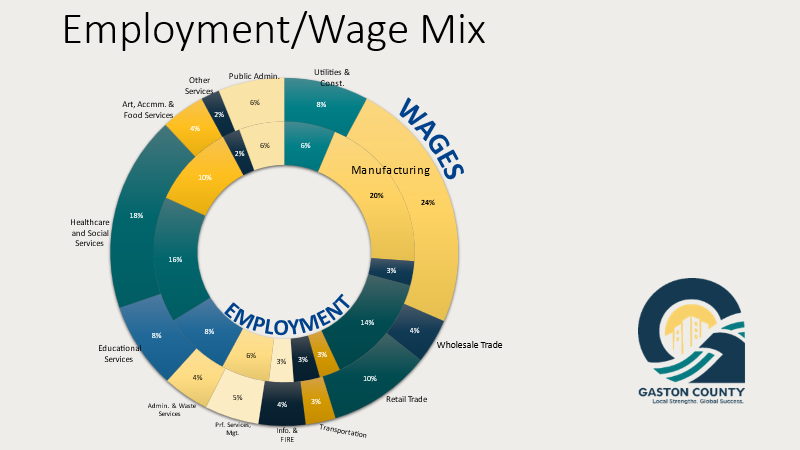

- Donny Hicks – Gaston County EDC – He expresses immense housing pressure on eastern and lower east side of Gaston County. Manufacturing and healthcare/social services are driving economy. Heavy medical concentration since county has its own healthcare system and is expanding $300 million into new facilities. He states workforce participation greater than ever before and continues to see a dramatic increase, even despite Covid. Same goes for retail sales. Workforce development, especially around trades, are being put in place. Spike in food and beverage. Single tenant investments are creating high-paying, white-collar jobs. Industrial growth booming with development activities like GNT USA, LLC and KNOLL America, Inc.s’ multi-million dollar investments in the more than 300-acre Apple Creek Corporate Center. Adding to this are foreign direct investments which account for approximately half of the existing expansions and new recruitment projects, i.e. Sweden’s Polykemi Inc. and Germany’s Aichele, Inc.

Recent Comments