Key Take Aways from Chicago’s July 2022 Mastermind Group Meeting!

- Activity has been busy in the environmental engineering space and Air Quality Impact Assessment Reports have been popular, including a new mini version that is sufficient for some uses. (Lauren Zangl – ECS Midwest, LLC)

- Interest rate hikes are having some impact but pricing continues to be favorable for data centers. It is unlikely that the need for digital and data storage is going away. (Rick Rembusch – Digital Realty)

- Green and environmental debt is becoming more important. (Rick Rembusch – Digital Realty)

- Madison Marquette is in the final stages of closing on 144 sites from Truist Bank, which is their largest acquisition (in total properties). They are already seeing a lot of interest in the locations. (Lee Utke – Madison Marquette)

- The investor market is strong and cap rates aren’t moving as much as anticipated. (Lee Utke – Madison Marquette)

- It has been more difficult to find properties in the medical office space and creativity has been important in order to get the returns investors expect. It has also been important to educate clients about the reality of the present in comparison to the past two years. (Corey Walz – Walz Capital, LLC)

- Seeing more developers looking for acquisition opportunities near the Redline Extension as well as the Invest South/West zones. There is a lot of public sector investment in those areas. (Casey Smagala – Chicago CityScape)

- A lot of developers are interested in Land Bank owned properties. There was a scavenger sale of 27,000 properties and only 5,000 sold, so some developers and brokers are looking for off-market acquisitions. (Casey Smagala – Chicago CityScape)

- There is a lot of interest by brokers in adaptive use properties in The Loop, including some buildings that could be apartment conversion opportunities. (Casey Smagala – Chicago CityScape)

- The future of the office market is still unclear and there has been a notable “Flight to Quality”, with companies looking to improve their space to encourage employees back into the office. Some companies are also considering satellite offices in the suburbs. (Grant Rich – Colliers International, Corey Walz – Walz Capital, LLC)

- Office space landlords have been flexible on concessions but not much on pricing. (Grant Rich – Colliers International)

- Pet-related spaces (including veterinary offices) and holistic/wellness spaces (acupuncture, spas, etc) have been very active recently. May be partially driven by couples deciding not to have kids due to the expense and lavishing their pets instead. (Kim Miller – Loberg Construction, Myra Nimchaiyong – Compass Commercial, Corey Walz – Walz Capital, LLC)

- There is a lot of adaptive re-use of properties, including turning a car wash into a day care. There is expected to be more renovation happening than building from the ground up. (Kim Miller – Loberg Construction)

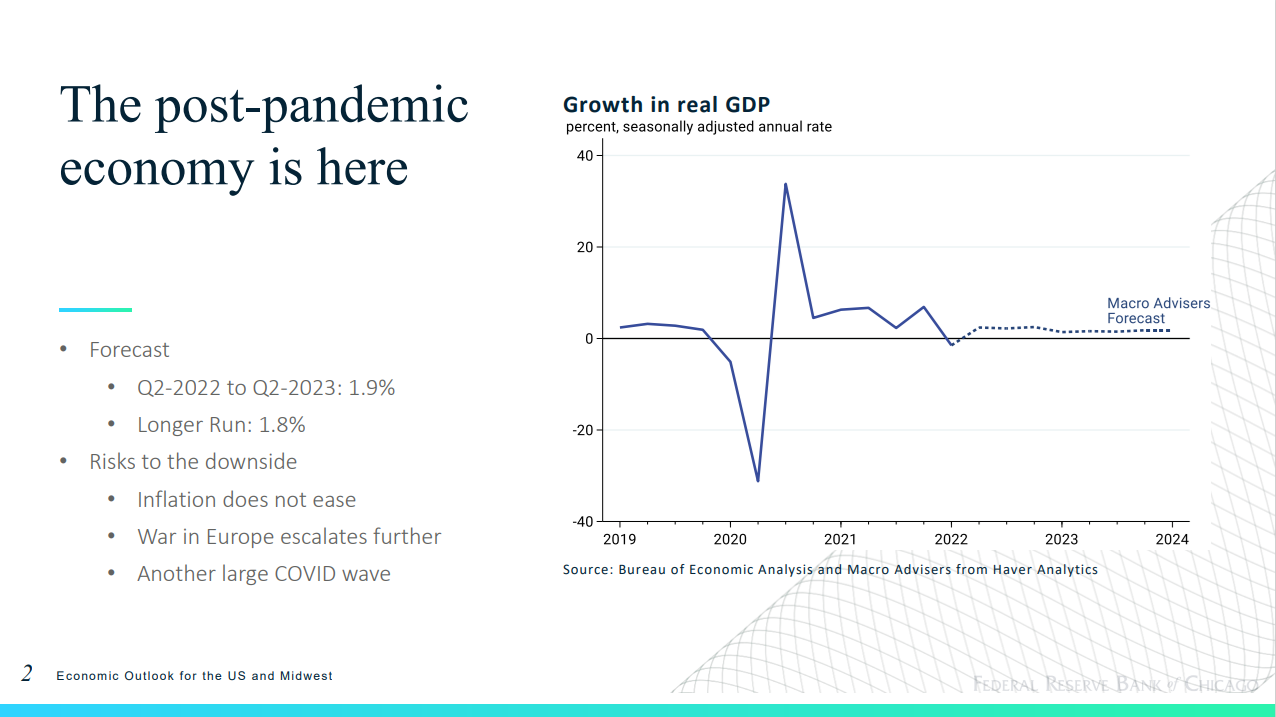

- GDP is expected to be “trend growth” over the next few quarters, approximately 1.9%. (Thomas Walstrum – Federal Reserve Bank of Chicago)

- Covid case numbers have been up, but deaths have remained flat, which suggests the possibility of a new normal where decisions aren’t made solely based on health and safety concerns. (Thomas Walstrum – Federal Reserve Bank of Chicago)

- Inflation has been more persistent than originally anticipated, so they may have to raise rates more than forecasted. There are a lot of concerns about a coming recession, but the Fed is anticipating a “soft landing”. (Thomas Walstrum – Federal Reserve Bank of Chicago)

- Illinois is slightly behind the average in job growth. States with larger amounts of hospitality and entertainment and states that were hit hardest in the first wave had the most difficult recovery. (Thomas Walstrum – Federal Reserve Bank of Chicago)

- States that had large job growth before the pandemic have had larger job growth through the pandemic, with the top quarter of states surpassing pre-pandemic levels. (Thomas Walstrum – Federal Reserve Bank of Chicago)

- Illinois and the Midwest have higher concentrations in manufacturing, which has resulted in slower recovery. (Thomas Walstrum – Federal Reserve Bank of Chicago)

- There is currently limited supply and a lot of demand, which is driving prices up. But demand is easing and while there are still supply problems, inventories are rising. (Thomas Walstrum – Federal Reserve Bank of Chicago)

- After the stimulus payments, there was a large increase in savings but now it’s down below pre-pandemic levels, which is part of the reason demand is easing. It’s taken longer for the stimulus money to be spent than anticipated, but by the end of the year it’s expected to have dissipated. (Thomas Walstrum – Federal Reserve Bank of Chicago)

- Core Personal Consumption Expenditure has been coming down the past few months, even though the Consumer Price Index has not been showing the same easing. While it’s been taking longer than expected, it does seem like there is an easing of the supply and demand issues. After initially expecting to be back at the Fed’s target of 2% inflation by the end of the year, it’s now expected to take a couple of years. (Thomas Walstrum – Federal Reserve Bank of Chicago)

Recent Comments