Washington DC March 2021 Key Take Aways

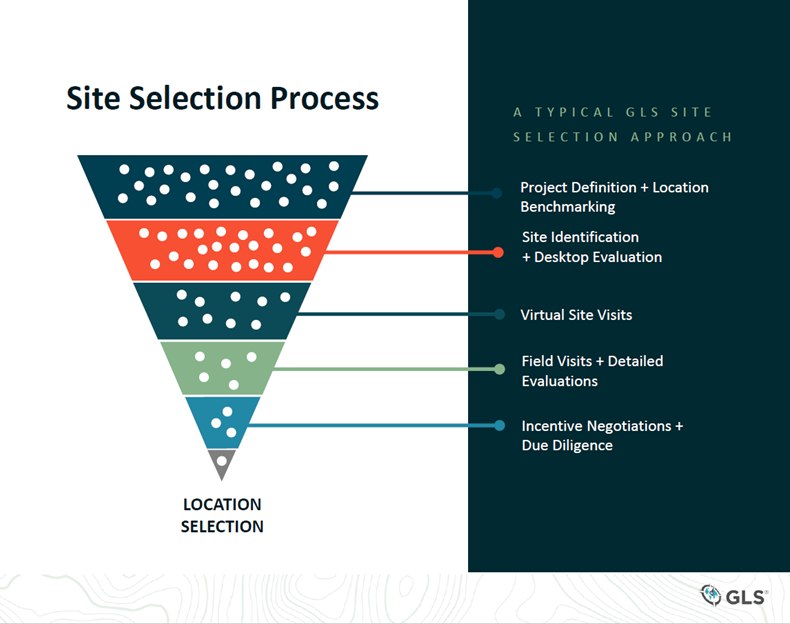

- Susan Donkers with Global Location Strategies provided a presentation on site selection and location benchmarking and how their technology, apps and expertise enable corporations to optimize their location strategy worldwide.

- Chris LeBarton with CoStar group talked about their newly released CMBS platform and how this has added more insight into distressed properties. Apartments are seeing some stabilization in occupancy and rent levels, but concessions are still high. Retail leasing negotiations are pending more than ever on how much outdoor space, extended parking or take away ability can be obtained.

- Brooklyn Manor has cleared its last hurdle with lawsuits, this property is owned by Mid-City and has over 550 current units which will be torn down for a massive redevelopment project according to Derek Ford with the Washington DC Economic Development Partnership. People are still looking to move companies and the WDCEP is working hard on business attraction and incentives to keep people.

- Chad Shuskey also with WDCEP shared some findings from their development report, that specifically covers DC Proper. Covid has had a big impact on the construction sector, over the past 10 years the city has averaged about 11M SF of ground-breaking, major project starts per year and in 2020 that number was about 6.5M, so a decrease of about 40% – 45%. However, that number is still higher than what we saw in 2008.

- Mark Remington with Phillips Realty Capital said that broadly speaking there is abundant capital ‘but it is as picky as I have ever seen it in my entire career.’ Bank capital is being driven by existing relationships; they only want to do business with their top clients. Life companies are still putting money out but are being very selective. There is virtually no money available for retail or hotel unless the retail is grocery anchored. Alternative financing sources like debt funds have plenty of capital and are a little less picky than the banks and life companies.

- Bruce Buchanan with Cherry Bekaert’s largest client shifted from office to multi-family a few years ago and has been seeing a good increase in occupancy in the 2 or 3 months. Some concessions are burning off and they are not having to give as much to get tenants in place.

- Steve Kenney with Cherry Bekaert remains busy with PPP loans and Employee Retention Credit. He did say that one positive sign he is seeing is the fact that as opposed to 2020 many of his clients are willing to come into the office and drop off tax forms, etc.

- Tom Gilmore with Madison Marquette elaborated on their soon to be announced retail opportunity fund. They are looking for ‘broken’ lifestyle, power centers, not regional mall players. Very focused on MD, VA as primary markets but have other areas as well. Seeing more stable rent collections.

- Keenan Woofter with NAI KLNB had an industrial deal for 80,000 SF brand new building in Manassas, 9.75 triple net. The numbers for still climbing for industrial and people are looking to buy, but nothing is available. The market is getting tighter.

- Kevin Welch with Loudoun County was super proud to announce that their Executive Director, Buddy Rizer was named one of the 50 most influential Virginians. Their office was focused on recovery during the pandemic but has switched to rebrand some of their strategy of how they recruit and retain businesses to the county. That includes their Broker/developer outreach program. Hopeful the upcoming Silver Line Phase 2 of the metro can help push activity along our metro developments. Last we heard the earliest it could open is end of 2021/early 2022.

Recent Comments