Key Take Aways from Philadelphia April 2021

• The industrial market in the Philadelphia region continues to be strong, with a 1% vacancy in the Philadelphia region. There is no available land to develop and there has been an uptick in southern New Jersey, with many projects being delivered in the past few years. (Carlo Batts, Rittenhouse Appraisals)

• Vacancy rates for multi-family in Center City are reaching 14% and leveling off. Short term vacancy is up due to additional supply, and the expectation is there will be more challenges in the coming year. Some multi-family units may transition to condos. (Carlo Batts, Rittenhouse Appraisals)

• Colleges being closed has had a large effect on rentals in the area. (Carlo Batts, Rittenhouse Appraisals)

• Biden’s stimulus plan aims to fuel up the single family market. (Carlo Batts, Rittenhouse Appraisals)

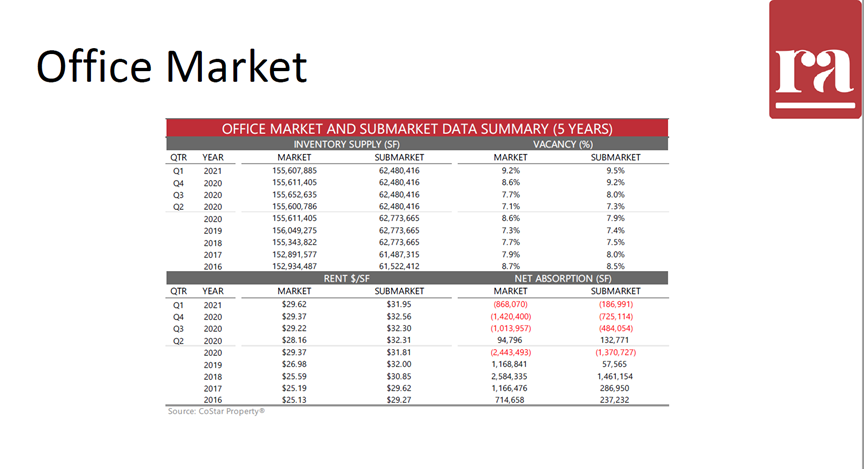

• People haven’t walked away from office leases yet, but the expectation is that many will in late 2021. There may be some activity as people from other markets look to Philadelphia as a cheaper alternative. (Carlo Batts, Rittenhouse Appraisals) Ballard-Spahr is looking at new space for their Baltimore office and will be transitioning from 33K sq ft to approximately 18-19K sq ft when their lease is up. (Bart Mellits, Ballard Spahr)

• Cap rates are expected to increase for shopping centers. Currently at around 8.5-9% and expected to hit around 11%. Expecting to see complete redevelopment of some shopping centers. (Carlo Batts, Rittenhouse Appraisals)

• The market is often wrong when predicting the rise and fall of interest rates. Rates consistently rise and fall faster than expected, which may or may not change moving forward. Cost of interest rate hedging and caps are going up, driven by market’s expectations. (Matt Hoffman, Chatham Financial)

• Vaccine rollout has people optimistic about going back to the office. (Matt Hoffman, Chatham Financial) It’s also creating new questions regarding meetings and working from the office. (Robert Bright, Talson Solutions) EisnerAmper reports that out of 175 employees there are generally around 4-5 people in the office at any given time. (EisnerAmper, Ed Opall)

• Ballard Spahr has a ban on all non-essential travel that will continue through September, though they are planning an event for the second week of October. (Bart Mellits – Ballard Spahr)

• Hotels are doing well in locations that are drivable vacation destinations. (Matt Hoffman, Chatham Financial)

• Insurance continues to be in a hard market, due to not only Covid-19, but also a record-breaking hurricane season, wildfires, and political and social unrest. Most commercial insurance markets are up from 7-14%. There are no profitable models for insurance plans to cover communicable diseases. (Matt Musilli, Johnson, Kendall & Johnson)

• Many members are seeing an uptick in overall activity, with lots of proposals (Robert Bright, Talson Solutions), new businesses looking to come to the city and more activity as far as street traffic and tourism over spring break (Job Itzkowitz, Old City District).

We help accelerate deal discussion and

follow-up by making it efficient,

accountable & measurable.

We provide senior commercial real

estate and development professionals a

meaningful way to exercise their

relationships.

We help you build trust and improve

credibility with the people you think

are important.

Recent Comments