Pittsburgh August 2021 – Key Take-Aways

- Mekael Teshome and Julianne Dunn of the Federal Reserve Bank of Cleveland gave an overview of economic conditions in the region and nationally, including inflation, labor market conditions, and monetary policy.

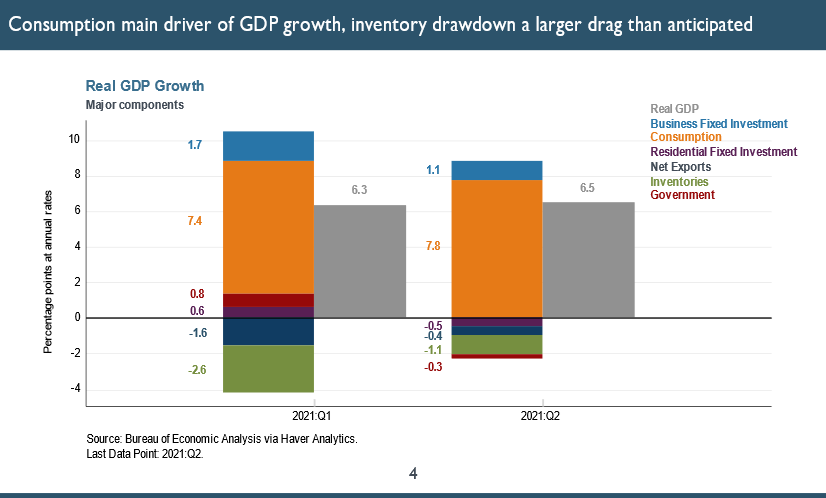

- At 6.5 percent, second-quarter GDP was strong, slower than what analysts had expected (9.1 percent). It’s a sign the economy has recovered. Third-quarter prediction is 7.1 percent, and for the full year, 6.2 percent.

- Housing and consumer spending are driving the recovery, even with supply chain problems.

- Stimulus payments boosted personal income, but most Americans put that money into savings, so economists are bullish this may equal spending in the future.

- Supply chain disruption = price pressure. At 5.4 percent, inflation is at one of the highest levels since the early 1990s. Even if you strip out food and energy, you still get a core reading of 4.3 percent.

- Fed and Blue-Chip officials predict inflation will be back to the 2 percent target by the end of the year, when supply chain challenges (hopefully) resolve and larger-than-normal price increases in the services sector, which is playing catchup after a year of Covid, quit.

- Labor market trends are improving but have a long way to go for full recovery. The most recent jobs data showed July was the best month since August 2020, but total employment down 3.4 percent since pre-pandemic.

- The unemployment rate is expected to reach 4 percent in fourth-quarter 2022. The labor market is taking longer to recover because of supply chain constraints.

- A surge of job openings started around March; a record number of jobs are open in the U.S. now and the pace of hiring has improved, but not to degree that you would expect given number of unemployed folks.

- Firms would like to add workers but are not getting interested or qualified workers.

- Some people blame the enhanced federal benefits of $300 weekly for keeping people from returning to work, but 26 states ended those benefits before Sept. 6 and haven’t seen an accelerated return to work.

- Other factors that may be keeping people out of the workforce include child care issues, since schools are not in session yet.

- Regarding monetary policy, the Fed is likely to leave interest rate unchanged until 2023, though some analysts think there may be at least one rate hike in 2022.

- It doesn’t look like we’re entering an inflationary spiral. 80 percent of the spike was Covid-related, involving sectors such as hotels and airlines that are influenced by shutdowns and reopenings.

- The Delta variant may be dampening activity but it’s unlikely to change underlying trends. With each wave of Covid, the hit on the economy was smaller, including with this one.

- The Pittsburgh region has more ground to recover in some areas. Consumer spending is lagging in the region and the labor market is behind. The Pittsburgh unemployment rate is closer to pre-pandemic level, but its labor force shrunk more than the national level.

- Pennsylvania’s shutdown may have been more severe than average and the reopenings were slower than average — trends that especially affect businesses such as restaurants.

- Pittsburgh doesn’t have the same concentration of cyclical industries that are experiencing rebounds.

- Bright spots: Housing sales are about at pre-pandemic levels, despite a recent slowdown and shortage of listings. Permitting is well above pre-pandemic levels, so construction should be robust in the months ahead.

- The Pittsburgh region also has a better handle on the spread of the Delta variant than the rest of the country. Two-thirds of Pennsylvania’s population has at least one dose of vaccine, which is well above the national average and better than most states. Hospitalizations have increased regionally but are in much better shape than most states and the nation.

- Retailers and manufacturers lacking workers have been increasing automation and some jobs will be lost to that, but they’re so short-staffed that demand will still overwhelm the supply issue even with additional automation.

- Pittsburgh is disproportionately geared to business travel, rather than tourism, so hotel occupancy is much lower here than in Florida, which is booked full. There was some improvement, but the Delta variant has caused that to level off.

- Anecdotally, there’s lots of shuffling going on especially among people at the low end of the pay scale, but no data to back this up. Factors include fear of the virus, child care issues, and perceived sector instability.

- There’s also shuffling further up the pay scale, with early retirements among folks in their late 50s or early 60s, seasoned professionals who decided to pursue work-life balance because the pandemic made them rethink quality-of-life issues.

- All of this will lead to an issue a year or so from now: difficulty matching job openings with employees who will want something while employers want something else.

- The Lambda variant coming out of Peru hasn’t caused much of a stir yet, especially since so many people are vaccinated, but there could be risk with more disruption of international supply chains.

- Locally, commercial real estate is going strong, with folks leasing offices even though people may not be returning to work full time. On the industrial side, 25,000 square feet is “bread and butter,” typical request, but Sarris Candy recently bought a 135,000-square-foot building with 36- or 40-foot ceilings.

- With the Southern Beltway opening soon, a lot of people want to be in Washington County now.

- Construction rates for industrial property are much higher than two years ago and people aren’t flinching. They want to be in this market.

- The first PACE (property assessed clean energy) financing deal may close by the end of this week, a $1 million retrofit of an office building, and a few others are in the pipeline. Pennsylvania was prohibiting PACE for multifamily housing but that is expected to be amended by the end of the year — excellent news for mixed use developments.

- There’s lots of interest in multifamily, beyond just student housing, especially in Ohio.

- Many architectural projects coming on line are smaller, but Ohio has $3 billion fund for real estate and is seeking proposals, mostly mixed-use with ground-floor retail, an office floor or two, and anchored by multifamily housing.

- The industrial sector in Pittsburgh is showing surprising strength in production facilities, not just R&D or office, but actual makers. Distribution centers are plugging along, too.

- Friday’s Census report showed a promising trend in the Pittsburgh region: an increase in population, however slight. The birth rate has been holding us back, and Allegheny County also has a smaller immigrant population.

- Construction folks need to reconcile the mismatch between people, skill sets and locations — people who can work from anywhere will begin to prefer that to being on a job site, and don’t want to travel as much for jobs. Quality of life has become an issue post-Covid, and construction isn’t always the most adaptable industry.

- Because of staffing issues and supply chain issues, some folks who hoped to put up a building in 2023 are learning it might be 2026 instead.

Recent Comments