Charlotte May 2022 – Key Take Aways

Guest Speaker, Julie White – North Carolina Department of Transportation – Julie is the N.C. Department of Transportation’s deputy secretary for multi-modal transportation. This includes NCDOT’s Rail Division, Integrated Mobility Division, Division of Aviation and Ferry System, which accounts for 5% of the overall $5 billion budget. She expresses excitement for the numerous federally funded grant opportunities that the state of North Carolina is well-poised to take advantage of in relations to mobility and multi-modal transportation.

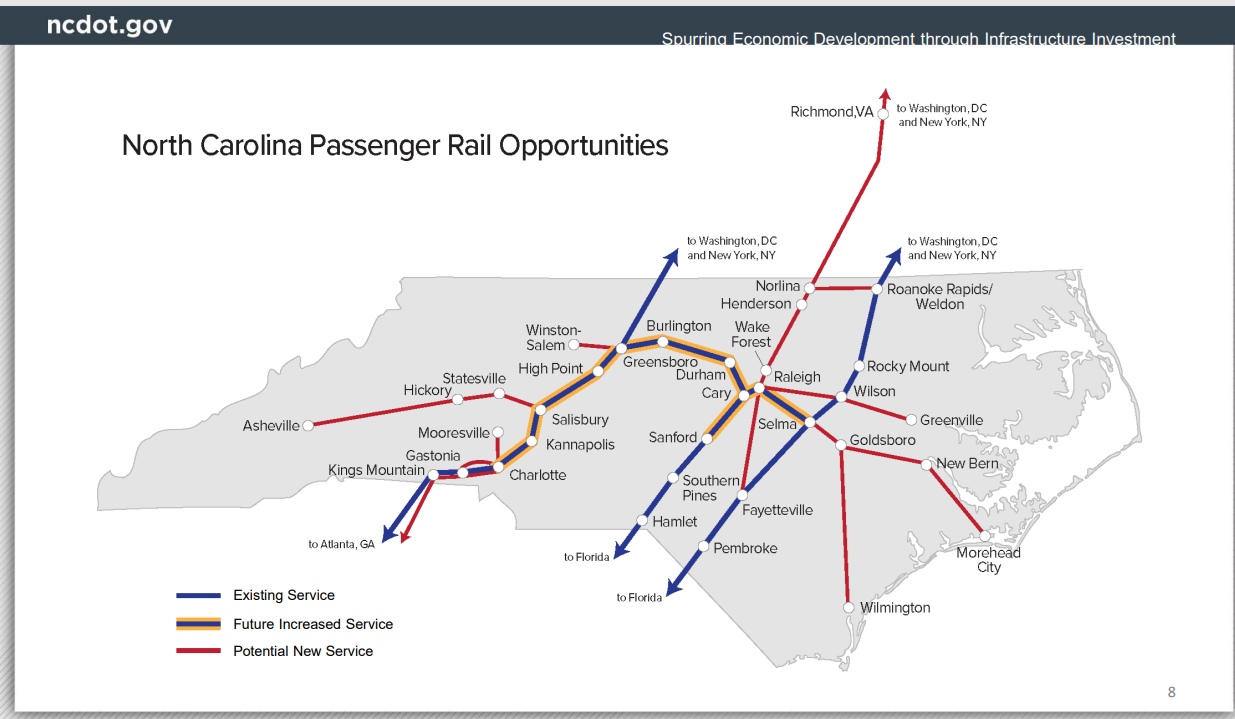

- Currently, NCDOT is focused on purchasing CSXT’s highly underutilized S-Line that runs from Raleigh to Richmond. The corridor is key to opening the entire Southeast to both freight and passenger rail services and creates opportunity that supports transit-oriented development (TOD).

- The future Charlotte Gateway Station, the red line connecting Charlotte to Atlanta. Tier I EIS complete. Grant applications are on the way for Tier II EIS. Florida-based, Bright Line, could possibly be private operator advancing this project. NCDOT led CGS Phase I Construction for tracks and platforms and are working closely with city and partners on next phase of mixed-use development. Piedmont Renewal and Investment in Modern Equipment (PRIME) provides $170 million in grant funds to replace current rehabbed Piedmont and Carolinian fleets with modern, technologically advanced trains and equipment.

- Julie moves on to discuss aviation, with North Carolina maintaining its “First in Flight” status with unmanned drone operations and delivery. The FAA issued a special permit which allows for beyond visual line of sight drone flights to occur. The first of its kind, Ehang, an autonomous air taxi from China, was demonstrated at NC Transportation Summit in Raleigh on January 8th and 9th, 2020. It flew unmanned and fully operational. NCDOT is currently working with the FAA to allow single-person Ehang air travel.

- Julie finishes with a discussion on the Integrated Mobility Division, with on-demand microtransit already here and growing in popularity in the city of Wilson. The Connected Autonomous Shuttle Supporting Innovation (CASSI) was deployed at the Wright Brothers National Memorial in Kitty Hawk in 2021. It was the first autonomous shuttle deployment at a National Parks site. NCDOT is adjusting design standards, with stops next in Cary, Davidson, and High Point Furniture market.

Brian Schoeck – Johnston Allison Hord – Brian heeds potential capital issues. First deal he saw where a buyer came back to the seller and said that cost of capital and rates are going up, and therefore closing needs to happen quickly and a price reduction needs to be negotiated. Seller responded favorably with willingness to accept tradeoff and move forward. He moves on to discuss his firm helped a developer client close on Brookdale Golf Club with a redevelopment opportunity for the driving range, which would subdivide the land and bring in more family, hotel and commercial uses. There was an increased awareness and sensitivity to the tax issue that the 1031 exchange purchaser/investor faced, so Brian and his tax team created a unique model for this particular development and can help with others facing the same predicament.

Matt Linville – Banker Exchange – Matt is a qualified intermediary, based out of Greenville, SC, with an office in Charlotte. He handles 1031 exchanges. He notices scarcity and dramatic increases in reverse exchanges are having an impact on clients. Office space has dramatically changed.

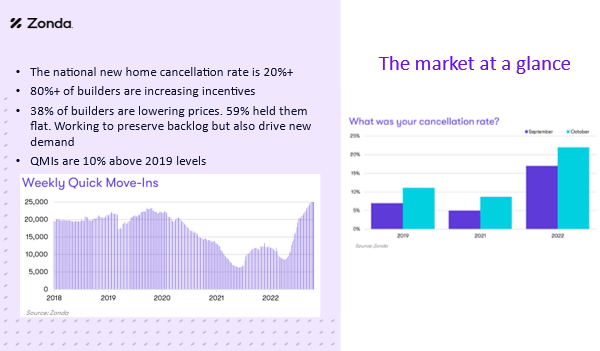

Joe Kinsey – CoStar Group – Joe claims developer and broker clients are beginning to see a disconnect between seller expectations, buyer expectations and what the lenders are willing to do. Lenders are saying deals are getting a lot skinnier. Cap rates are so low, especially in multi-family.

Chuck McShane – CoStar Group – Chuck states we are at a transition point with multi-family investment, although he still believes it is still going to be a strong property type. On the industrial side, consumer spending is shifting. Chuck predicts this will be a tailwind for neighborhood retail. There hasn’t been much construction over the last several years therefore the next push in space and absorption will be in this sector. He notes the average size of leases pre-2015 versus today are down substantially.

Matthew Martin – Federal Reserve Bank of Richmond – Matt declares target short term rates are approximately 2%. He claims we’ve seen peak inflation rates and there are some good reasons to think it slows from here, but it will not get back to 2% target this year. The economic interest rate should slow down.

Russell Hughes – Hughes Realty Advisors – Russell notices deals are falling out and buyers are starting to get really touchy. The economy has flipped, creating enough doubt for many to discontinue.

Tanna Thomas – Terracon – Retention, routine and recruiting are factors Terracon’s currently focused on. Tanna is seeing big uptick in all projects, especially in Uptown and South End.

Recent Comments