Charlotte November 2022 – Key Take Aways

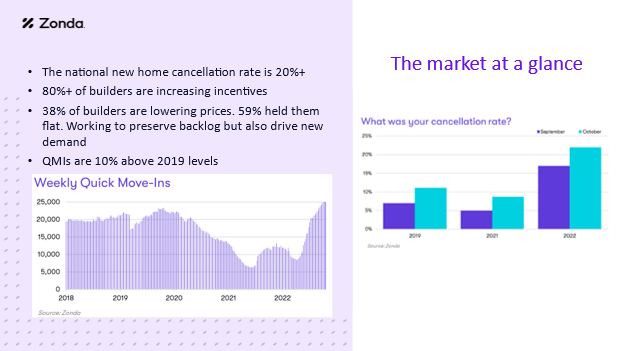

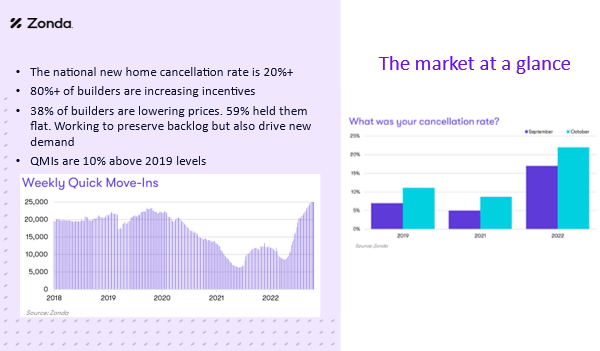

Shaun McCutcheon – Zonda Home – Zonda Home was formed by the merger of two companies – one of which provided reports that helped builders on major markets across the country, and the other focused on tracking new home subdivisions that were actively selling. The two had many data-driven applications that complemented one another, thus creating a platform which provides housing market data and real estate analytics to home builders, developers, and commercial investors. Shaun begins by stating how price cuts are increasingly common. Sellers are willing to accept more reasonable, less inflated prices than before. However, the national consensus is more bearish than the Charlotte and overall Carolinian experiences. Homebuilders now have to give buyers increased incentives as well, especially towards closing costs, in order to commit them to buying. They’re willing to put in cash to create a lower interest rate for the buyer. These instances are seen across the country on a case-by-case basis. Charlotte builders generally refuse to give subdivision homes away in such a manner and will maintain pricing instead of selling. Ironically, sales volume is holding up relatively high in Charlotte. Listings, however, are down in the resell market with Charlotte homeowners. They have more liquidity and flexibility with their locked-in 3% interest rates, whereas first-time buyers struggle with a current 7% interest rate along with other challenges faced to get qualified. Owners have zero interest selling a home, finding another, only to end with a 7% interest rate too. Shaun proceeds to describe where the majority are projecting their highest interest rate levels. Early 2023 is considered to be the peak of interest rates (at 8%) with flattening seen in the latter half of that year. 2024 is a mystery with projections all over the place. 2025 and 2026 rents are projected to come back down. In terms of monthly payments, Charlotte has had one of the sharpest increases in the country. As of December 31, 2021, rent was $1153 per month, and because of higher appreciation and rising interest rates, that has gone up over $2,000 per month. Shaun continues with discussion on supply and oversupply. Cities such as Phoenix, Austin, Miami, and Atlanta have so much supply they could see price drops, whereas Charlotte has a supply higher than normal but not quite at a red flag level that would cause pricing to change. Yet, Charlotte is still listed as #4 in the Top 15 states people are migrating to because of jobs, lower cost of living and moving closer to be with family.

Brian Schoeck – Johnston Allison Hord – Brian quickly mentions an application currently under review for the Idlewild Rd./I-485 project in Matthews, which proposes 660 new residential units, containing a mix of both attached and detached.

Joe Kinsey – CoStar– Joe claims multi-family has had the biggest supply concerns in terms of overbuilding, listing Raleigh, Phoenix, and Las Vegas as cities with record highs. In office, rents are still maintaining. Smaller leases are being signed, yet still coming to close. He is interested in seeing how the extended/protected Covid leases which are set to expire soon will play out. Retail is strong for the most part. The main concern lies in bringing the right tenant in to lease. Industrial leasing is hot, but sales are down everywhere. Joe states everyone wants to know loan/debt maturity dates in CoStar’s database in an attempt to go after those who sell/assume loans.

Joe Marek – Johnston Allison Hord – Joe discusses ULI’s Emerging Trends in Real Estate 2023 report, published recently on October 27, 2022. The report describes how the economy is being defined by inflation and high interest rates. However, real estate professionals interviewed for the report remain “cautiously optimistic” that next year will return to somewhat pre-Covid levels, although spaces like office, business travel and shopping have been influenced beyond return. Joe finishes with mention of Charlotte in the report’s Top 10 for Overall Real Estate Prospects.

Gates Grainger – Investor’s Title – Gates shares the success title insurance has had in recent months and within the entirety of the past few years because of its involvement in all of commercial real estate and not solely one aspect of it. Although deals have sunk within these recent months, they still exceeded goals compared to those in 2019. November numbers will not be reached, however workwise they will be busier than ever closing commitments made from earlier in the year. New construction loans for an apartment complex and storage facility are also in the works. He, too, remains cautiously optimistic.

John Culbertson – Cardinal Partners – John provides strategic, advisory services for complex commercial real estate dealings. He is currently advising a client who owns approximately 80 acres, in the heart of the much-anticipated River District. The River District is a 1,400-acre master-planned community connecting urban lifestyle to the outdoors. Similar to Baxter Village, it will boast a 70-acre Scandinavian-design village, with 30,000 SF of retail, 4-story office building and a garden area. John predicts buildings to be completed 18-24 months out, and sewer and water in both 18 months.

Jeff Mitchell – Duffey Southeast Construction – Jeff spearheads the Carolinas as Duffey Southeast’s Charlotte Director. Although industrial project designs are currently very strong, he believes they will eventually flatten out due to cost of funds, supply and high interest rates that are creating difficulty in deal-making. However, he is also cautiously optimistic since the Southeast is positioned very well.

Recent Comments