Charlotte April 2023 – Key Take Aways

Charlotte is still more affordable than coastal states and has seen population growth nearly triple that of the rest of the country within the last 5 years. (Chuck McShane – CoStar Group)

Multi-Family demand has declined since 2020 although supply remains high and is expected to outpace new demand until 2025. An increase in vacancies of 9% is due to construction coming online. 22Q4 saw the lowest apartment absorption in more than a decade, whereas 21Q3 saw the highest apartment absorption since 2000. Annual rent increases have slowed across all submarkets. (Chuck McShane – CoStar Group)

Office jobs returned much faster after Covid. Office-using job cuts accelerated around the turn of the year. 23Q1 saw the largest negative office absorption from giant companies like Duke Energy, Wells Fargo, Bank of America. All have reduced their footprint and lay-offs can be expected to come to Charlotte. Charlotte office tenants are moving from Uptown, Ballantyne and University area to newer locations with the average lease shortening. Older towers in the Charlotte Metro area are becoming delinquent on office CMBS loans and will continue to rise in 2023. (Chuck McShane – CoStar Group)

Industrial is experiencing a tickback in large durable goods from the big buys of 2020 and 2021 due to supply chain challenges. Savannah and Charleston have more shares of import and few labor challenges. Leasing is moderating. Supply began to outpace in 22Q4, although still a tight market. There is some rise in vacancies, almost at 2019 levels. However, more supply to lift these vacancies in Charlotte. Not much activity has happened to determine change in cap rates. (Chuck McShane – CoStar Group)

There is a more cautious approach to retail because of overbuilding in 2006-2008. New construction has declined, with spaces quickly backfilled. Vacancies are lowest in freestanding and power centers, yet highest in malls, neighborhood centers and strip malls. Charlotte is among the top markets for retail absorption and rent growth. (Chuck McShane – CoStar Group)

John recently placed 276-acres in Pickens, South Carolina, under contract and will see it through the entitlement process. (John Culbertson – Cardinal Partners)

John needs volunteers for honest truths about an assessment he created called the STP scorecard. It evaluates a real estate acquisition based upon 10 questions for seller circumstances, 10 questions around the transaction structure and 10 questions around the property characteristics. It provides a score at the end and gives an idea of how much value is in that acquisition. (John Culbertson – Cardinal Partners)

Data shows clients want to see loans that are maturing and short-term multifamily debt that backed on 20% rent increases that are now 1% and will find challenging if they have to rebuy. There’s plenty of capital that is interested in that washout on the multifamily side. (Joe Kinsey – CoStar Group)

CoStar integrated 12,000 private equity funds. The same people are looking for co-investment funds that are targeting the Southeast and buying multifamily or industrial. (Joe Kinsey – CoStar Group)

The economy is slowly decelerating. Inflation is likely to continue to turn downward assuming wage growth slows. Markets expect the Fed will raise at the next meeting but then take it back at the end of the year, and that is not what the FOMC projected at the last meeting. There is a gap and somebody is going to be wrong. Gaps are disruptive when they close. (Matthew Martin – Federal Reserve Bank of Richmond)

Gates warns of vacant land scams where actual owners of vacant lots are unaware that their land is being sold with forged deeds. He encourages buyers to dig deeper and meet with owners who ask for payment by certified check (NOT wires) to avoid this. (Gates Grainger – Investors Title Company)

Employers are taking a more aggressive stance to pull employees back into the office by treating in-office attendance as a performance metric tied to employee bonuses. This will hurt employees if they continue to work from home. (Joe Marek – Johnston Allison Hord)

Healthcare is expanding once again in Iredell County due to Terracon’s clients, Atrium and Novant Health. (Ron Rothfuss – Terracon)

Terracon has 2 multi-family towers on the books for this summer that they’ll carry for the next 2 years. (Ron Rothfuss – Terracon)

Terracon is slammed with EV chip manufacturing in surrounding markets like Savannah, Greensboro and Florence. (Ron Rothfuss – Terracon)

Terracon is still short on labor but has seen a leveling off of wages. (Ron Rothfuss – Terracon)

Q422 was the best quarter BankFinancial has ever had in terms of loan production, with overflow into January 2023. (Jeffrey Pirhalla – BankFinancial)

There are primarily 4 different verticals within the bank that are primary producers. Jeffrey’s group’s area is one of those and they tie funds to cost of funds and essentially follow the Fed. Last year, multifamily rates were anywhere between 30-70 basis points inside of agency. Now they are even or 10-20 points above. (Jeffrey Pirhalla – BankFinancial)

Overall, the opinion is that real estate is in a good place. Jeffrey predicts the dust will settle in 18 months. What he thinks needs to occur is stagnancy needs to be removed from the market and once things begin to move opportunity can occur. (Jeffrey Pirhalla – BankFinancial)

Doug and his company focus on the commercial hotel sector, specifically on the mid-to-upper scale Hilton and Marriot-branded hotels. By seeking development opportunities in secondary and tertiary markets, his company has built a very successful business. He has hotels in two of the top 3 most prosperous counties in Georgia and is looking to expand into Griffin, Georgia, if the incentives are right. (Doug Stafford – Griffin Stafford Hospitality)

Doug discusses CMBS loans and the success he’s had with them. He recently paid off his last one and has decided to refinance with a balance sheet lender instead who has offered him a great fixed rate for the next 7 years. (Doug Stafford – Griffin Stafford Hospitality)

CJ specializes in office and states the general demand for it is currently low with exception of medical offices. Many doctors who have owned their offices for 10+ years are entering retirement and looking to sell. (CJ Wilson – Marcus & Millichap)

National Land Realty takes their clients’ site criteria and searches for land using local knowledge, data and technology. According to Peter, identifying land is easy. The hardest part is creating sellers and that requires interpersonal skills. (Peter Mazeine – National Land Realty)

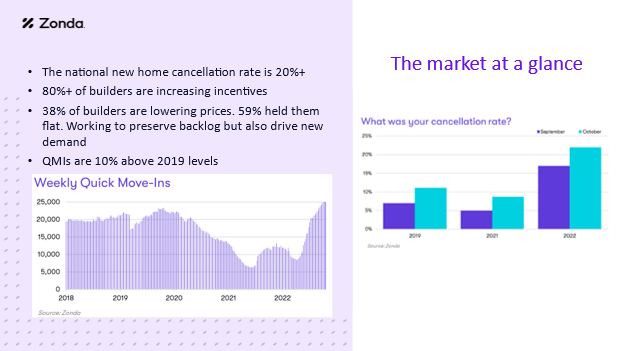

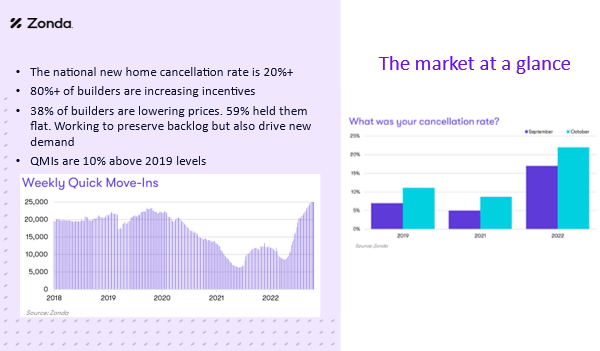

Managing expectations has been the greatest challenge. Buyers are eager to make purchases and are waiting for sellers to lower prices yet sellers are refusing to since they believe what they have is much more valuable. (Jeff Alexander – The Nichols Company)

CBDs are starting to lose businesses to the suburbs. The flight quality in University City is real and has been absolutely quiet for any real interest since the Centene building. (Tobe Holmes – University City Partners)

Tobe watches R&D popularize in places like Raleigh and believes this space can be a great match for University City if they can figure out how to bring it closer to Charlotte. (Tobe Holmes – University City Partners)

Sellers want buyers to come up and buyers want sellers to come down and there hasn’t been that spark to prompt the activity yet. (Brent Kubitschek – Waterstone Multi-Housing Advisors)

Brent is seeing more property owners having a hard time getting their loans for new projects. Instead of calling 1 or 2 lenders, they’re now having to go further afield by contacting 4 or 5. When it finally happens, the loan terms are more strict and service-based for out-of-state clients and require a larger history and deposits on file. (Brent Kubitschek – Waterstone Multi-Housing Advisors)

Danforth Construction is a commercial contracting company with projects throughout the Charlotte area including Morningstar Storage facilities and several restaurant and gym renovations. (Gibb Heilman – Danforth Construction)

Recent Comments