Milwaukee July 2023 Key Take Aways!

Jim Dash – Carlson Dash – Shared Associated General Contractors national report – Construction up 2.6%, residential construction employment up 1.6%, non-residential up 3.2%, & construction wage premium remained considerably below 2019 average.

Mike Bahr – Plunket Raysich Architects – Seeing RFPs & RFQs dry up, recently paused projects picking up, and a long backlog but suspects there will be pressure from consistently high construction costs.

Mike Brush – Plunket Raysich Architects – Seeing corporate work drying up and a rise in buildings coming available for conversion. Recent renovations in Brookfield were completed however tenants are slow to enter.

Scott Kramer – Plunkett Raysich Architects – Shared the firm is very busy with well over a year of backlog but cannot hire enough, still understaffed by 15 people. Outlook for 2024 is extremely good, predominantly in k-12 school referendums, approx- half a billion. Not anticipating a recession in regards to work.

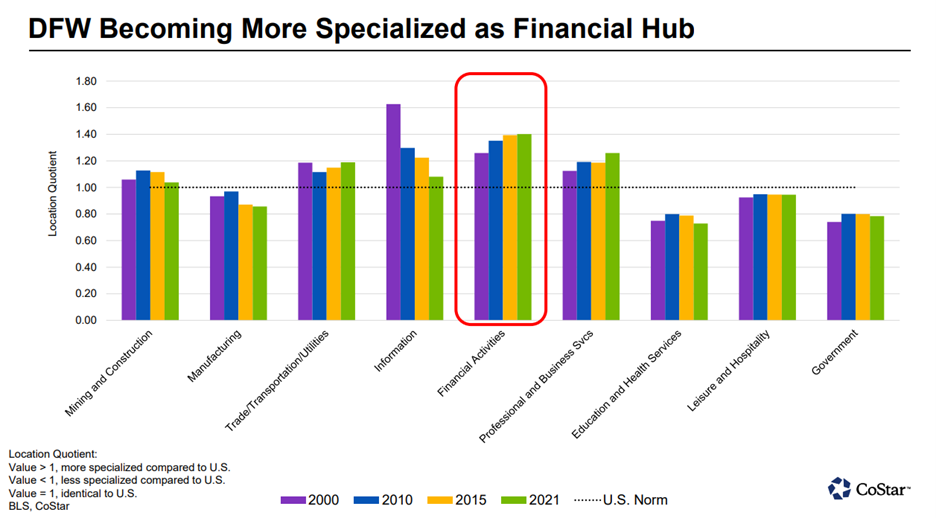

Gard Pecor – CoStar Group – Concerns in local staffing issues and employment growth, still down 2.5% (roughly 22,000 jobs). MKE office market is booming compared to the rest of the country, available space increases in suburbs 7.5% & downtown 2.9%. Downtown MKE is a national leader in office conversions, seeing 7.5% of the downtown inventory being converted to multi-family and hospitality since 2015. MKE and Madison are among the top 5 markets in the country with the lowest vacancies. Industrial and multi-family are the lowest in the past 5 years and consistently underbuilt.

Nick Hepner – JLL – Seeing more medical/retail in new development.

Justin Monk – MSA Professionals Services – Seeing municipal governments growing and more building expansion work. Currently has a significant backlog and staffing issues, primarily in senior staffing. Has been tracking longer wait times on approved designs, jumped from 3 weeks to 8 weeks over the last 9 months.

Jerry Krings – Carlson Dash – Seeing residential still strong in desired areas, commercial slow down, and fewer business sales. Foresees slow down regarding increase in defaults, especially in commercial agriculture.

Andrea Bukacek – Bukacek Construction – Seeing good volume but many delays in permitting and approval process. Cited higher interest and labor rates (4% increase) as setbacks.

Ryan Folger – Commercial Investors Group – Seeing leaner transaction volume, sellers taking assets off the market for hopes of better prices, and a company shift away from office work due to rising economic concerns.

Jennifer Green – Green Commercial Realty Advisors – Seeing a national cry for affordable housing.

Andrew Jumbeck – Harmoniq Residential – Seeing a limit to local building, a lack of affordable housing, and more rent/buy decisions on single family.

Randy Scoville – Interspace LLC – Seeing a fair drop in second quarter, mainly office project delays due to pricing and term.

Conrad Scoville – Interspace LLC – Seeing employers struggle with hybrid workforce dynamics and labor market shortages.

Matt Riesterer – Luther Group – Seeing investment rates rising and acquisition opportunities slowing.

Joe Schmidt – Tri-City National Bank – Seeing rent increases, rising cost of funds, and less lending. Projecting slow growth.

Recent Comments