Dallas January 2024 Key Take Aways!

Marichelle Samples, Director of Economic Development for the City of Lewisville. Marichelle began her career in Lewisville in January of 2022 and has approximately ten years of local government experience. Her main focus is implementing and coordinating economic development policies and related activities in the City of Lewisville. Below are some highlights from Marichelle’s presentation:

• She calls Lewisville “Young and Restless” due to its “dominant tapestry segment”:

(Tapestry is a market segmentation system built from using a large, well-selected array of attributes of demographic and socioeconomic variables to identify numerous unique consumer markets throughout the United States.)

• Lewisville currently has a total population of approximately 133,300 and a daytime population of approximately 122,300.

• The City of Lewisville “prides itself” on the following items:

o Low tax rate – Low property taxes will long outlast any abatement or one-time incentive that can be offered by a municipality. With one of the lowest combined tax rates in DFW, Lewisville businesses can keep taxes low on their valuable improvements. Businesses and workers in Lewisville can keep more of their hard-earned money and prosper in a tax-friendly environment.

o Close proximity to DFW, Alliance and Love Field airports

o Fastest growing Metro area with the region adding more people than any other US metro between 2021 and 2022, with 170,396 new residents.

o Growth is expected to continue with business expansion and relocations fueling the growth in DFW, putting it on track to overtake the Chicago aera and become the third-most-populous metro within the next decade.

o Various incentives

o Business friendly

o The Development Review Committee is a one-stop shop who will review your plans with the development Review Team. They have weekly internal meetings to ensure quick permit turnaround.

o The City has partnerships with the following: Lewisville Area Chamber of Commerce; Small Business Development Center – North Central Texas College; and LISD (Lewisville Independent School District)

o The following incentives:

Chapter 380 Tax Grants including: sales tax; real property; business personal property; and local construction purchases.

Waiver and/or reimbursement fees including building permit fees; water/sanitary impact fees; park fees; and roadway escrow fees

Façade, grease trap incentives – Façade 50%, max $40K and Grease Trap 50%, max %7,500

Speculative Building Grants – 50% reimbursement of real and personal property taxes for 5 years and tenant grant opportunities.

o Tax Abatements:

Corporate/Regional Headquarters

Average Salary – $60,000

Payroll – $8,000,000

Real Property – $10,000,000

Personal Property – $1,000,000

Targeted Site – as identified in City’s long range and master plans

Annual Taxable Sales & Uses – $25,000,000

(Must meet two of the above requirements)

• The 2025 City of Lewisville Vision Plan includes the following:

o Small Area Plans

A Small Area Plan gives residents, business, property owners, and the City a shared “road map” for actions and investments to enhance one particular area within Lewisville. Anyone who has a stake in the area can be involved in creating the Small Area Plan, so everyone’s ideas and concerns can be considered in deciding how to make the area a vital, successful, and desirable place to live and work now and in the future. Also, creating these plans is consistent with the “Thriving Neighborhoods” Big Move in the Lewisville 2025 vision plan, and can impact several other Big Moves in that plan.

o Why the City is Creating Small Area Plans:

This is a proven way to establish a vision or goal for a specific part of a city, and a coordinated approach to achieve it that is supported by area stakeholders. The plans will focus in more detail than is possible during a citywide planning process.

Small Area Plans can be used to address areas with unique challenges and opportunities, and can help create or enhance a distinctive identity for those areas. This makes those areas more desirable places to live or operate a business, expanding quality of life and preserving economic viability.

The planning process will get stakeholders involved and engaged. The resulting plans will serve as the basis for city programs, incentives, regulations, and special districts that are important in the targeted area but are not needed citywide.

James Smith, Managing Director at Smith, Jackson, Boyer & Bovard “SJBB”, a Dallas based, full-service CPA firm.

• Tax season begins Monday, January 29, 2024. With that being said, the IRS is still struggling answering phone calls, responding to emails, etc. To adequately train an IRS agent to be an auditor it takes up to three years of training. Also, it takes at least one year to train someone who answers questions over the phone.

• Much to Jim’s surprise, Congress passed a Bill titled “Tax Relief for American Families and Workers Act for 2024”, which is a bi-partisan Bill that the Senate Finance Committee and the House Ways Committee agreed on. This Bill would expand the child tax credit for three years and allows families with multiple children to take advantage of the credit. The current cap for the refundable child tax credit is $1,600. Under the bill it would lift the amount to $1,800 in tax year 2023, $1,900 in tax year 2024 and $2,000 in tax year 2025 and begin adjusting for inflation in 2024.

• Jim reminded everyone that the Corporate Transparency Act: began January 1, 2024. The US Corporate Transparency Act (CTA) will require corporations, limited liability companies, limited partnerships and other similar entities to disclose beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN), a bureau within the US Department of the Treasury. Also, all entities formed or registered to do business in the United States will need to either (i) confirm they qualify for an exemption from the CTA’s reporting requirements or (ii) timely submit a beneficial ownership information (BOI) report to the U.S. Treasury’s Financial Crimes and Enforcement Network (FinCEN).

John Rhodes w/ Foresite Group, leads their Land Development Practice Area nationwide and focuses primarily on civil engineering projects west of the Mississippi River.

• John is seeing a lot of small tenants “pick back up” such as McDonalds, CVS, Chick-Fil-A, to name a few.

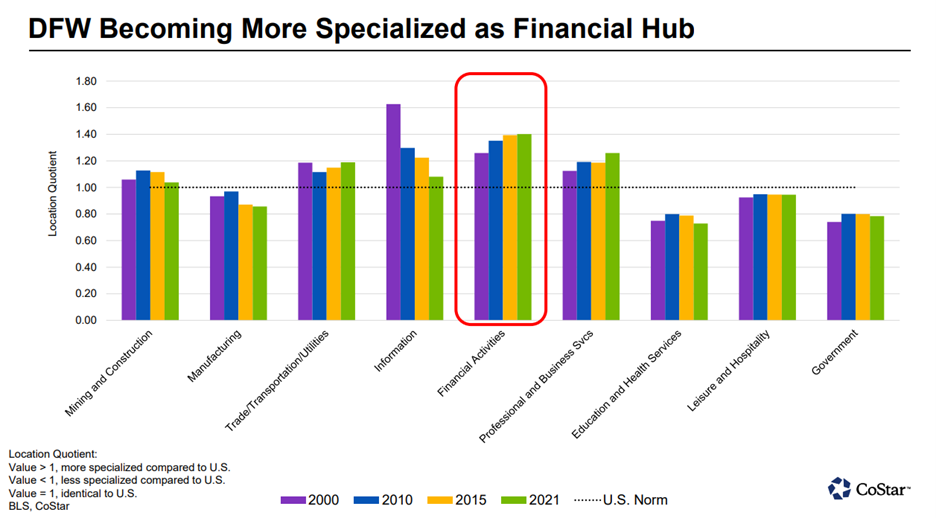

Bill Kitchens, Director of Market Analytics w/ CoStar Group:

• Retail is “killing it” because people continue to spend money, which is exactly why credit card debt is “back on track”.

Sue Turk, currently w/ Cava Enterprise, shared that she is officially opening her own Title Company and already has her office space and licensing in place so it’s all “falling into place” and she is excited to begin this new Chapter in her life.

Recent Comments