Hampton Roads December 2021 – Key Take-Aways

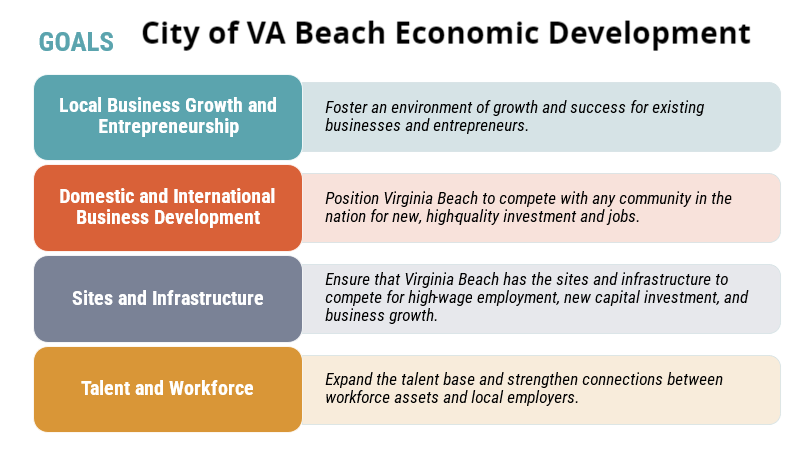

- Taylor Adams Deputy City Manager/Director of Economic Development with the City of Virginia Beach provided an overview of the City of Virginia Beach’s economic growth.

- Virginia Beach is the largest city in the commonwealth and is still growing larger than the city itself can sustain. This of course comes with challenges.

- The biggest challenge we have in VA beach besides a shortage of real estate is work force. A labor force of about 237,000 with a current unemployment rate of 2.37%.

- One of the biggest things the city is looking at in 2022 is proving to the development community that speculative space in VA Beach is a good idea.

- Historically, if you back up 20-25 years VA Beach grew at the expense of its neighbors, however if you look at the past 10 years, the data reflects that the city has grown at the benefit of its neighbors.

- The last ten years, particularly coming out of the recession, organic growth is happening in the Hampton Roads Area.

- The VA Beach area is hosting the birth of a new industry that is coming to the US in offshore wind.

- There is excitement in the development of a new industry coming to the US from Europe in renewable energy. “However this does not lead me to believe that we need to stop pulling oil out of the ground.” The oil industry and the renewable energy industry are complimentary industries rather than being competing industries.

- In regards to workforce in our area, people are finally coming back to work, slowly, but coming back.

- It isn’t about having labor in the market, it is about having labor that is qualified to do the available jobs in the market.

- The problem with this is that if we do not fix this and get labor in the market fast enough the business community will innovate. This innovation will look like technology replacing those human assets.

- The biggest challenge in VA Beach for this labor is not having housing stock to put people in.

- The last five multifamily projects that were done in VA Beach were 100% leased the day the certificate of occupancy was issued.

- Internationally, several business want to be here, and will come here, because they know that once they get to the point of distribution, the port of VA is a great place to bring products in.

- Richard Crouch with Vandeventer Black.

- We feel as if we are seeing more transactional volume over the last year and last quarter.

- Sales make up about 2/3 of what we are currently working on.

- Pamela West with PNC Healthcare.

- COVID has shifted the mindset of the average patient. This has shifted the layout of medical practices. The newer offices with newer equipment and technology tend to draw the new customers and draw customers away from older practices.

- A lot of times it is cheaper to do a full build-out vs a renovation and update.

- We are seeing a lot of hospitals getting rid of smaller specialties and turning them over to individual doctors.

- Keith Slattum with Dollar Bank.

- The Bulk of PPP loans gave been forgiven and most companies did not use the loans due to the concern of the timeline of repayment. That money sat in the bank, and now that loans have been forgiven expect to see a big pop in capital investment.

- Jake Elliker with Whiting-Turner

- There is an aging workforce that doesn’t need to go back to work. There is a need for independent living, assisted living and senior living.

- Victoria Pickett with Colliers International.

- There has been an exponential increase in pricing.

- In 2019 we closed the first deal in Hampton Roads that surpassed $200k per unit. Prior to that you would see deals in the upper 100s.

- Today, we are seeing 1970s vintage deals eclipsing $180k dollars a door.

- Since that deal in 2019 we have seen over 8 deals in the southern part of the state between Hampton Roads and Richmond, transact for over $200k a door, getting close to the $300k mark.

- A Beach saw an 18% rent growth in 2021.

- Future rent trends are predicted to see a growth of 4% to 7% next year with an average rent growth of 5% over the next 5 years.

- Don Crigger with Colliers International.

- In the office world during the last 18 months no one wanted to transact anything outside of a 1 year extension. But now, over the past 90 days I have people moving forward and securing 5 year extensions, and they are doing this well in advance of their current lease ending.

- What I have noticed is that whatever companies adjust to do more with less, other companies want that space.

Recent Comments